does massachusetts have an estate or inheritance tax

In the case of inheritance taxes spouses children or siblings often have different exemptions which we list in detail in table 35 in the 2015 edition of our annual handbook Facts Figures. The terms inheritance tax and estate tax are often used interchangeably but they are very different things.

Estate Inheritance And Gift Taxes In Connecticut And Other States

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax.

. A family trust can have significant savings for Massachusetts couples in this example 200000. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both.

Unlike most estate taxes the Massachusetts tax is applied to the entire estate not just any amount that exceeds the. If youre responsible for the estate of someone who died you may need to file an estate tax return. Create Your Legal Will in 20 Mins.

Massachusetts and Oregon have. Fortunately Massachusetts does not levy an inheritance tax. At the moment of death an inheritance tax lien.

Maryland and New Jersey have both. Well in short that means that if you die during 2006 or any time thereafter you do not need to file a Massachusetts estate tax return if you have less than 1000000 in assets. Fortunately Massachusetts does not levy an inheritance tax.

The inheritance tax is still applicable to the estates of persons who died on or before December 31 1975. Schedule a free consultation today. If the estate is worth less than 1000000 you dont need to file a return or.

Any family estate in Massachusetts worth 1 million can benefit from. Ad We specialize in Massachusetts Estate Planning. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Twelve states and Washington DC. The Massachusetts estate tax would be about 900000 if you were a resident of the Commonwealth at your death.

In Massachusetts an estate tax is generally applied to estates which exceed 1 million based on a progressive rate scale with rates starting at 08 and increasing to 16. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. The graduated tax rates are capped at 16.

The estate tax is a tax paid by the estate of a deceased person if. Currently fifteen states and the District of Columbia have an estate tax and six states have an inheritance tax. A recent report from the Tax Foundation says in 2022 there are 12 states and DC with an inheritance or estate tax with one state Maryland having both.

Ad 3995 100 Money Back Guarantee.

Massachusetts Estate Tax Everything You Need To Know Smartasset

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Is There A Federal Inheritance Tax Legalzoom

Massachusetts Estate Tax Return M 706 Pdf Fpdf Docx Massachusetts

State Estate And Inheritance Taxes Itep

Five Taxes Your Heirs May Pay Or Not After Your Death Ssb Llc Samuel Sayward Baler Llc Dedham Ma Lawyers

Fixing And Expanding The Estate Tax Intervening To Reduce Wealth Inequality Institute For Policy Studies

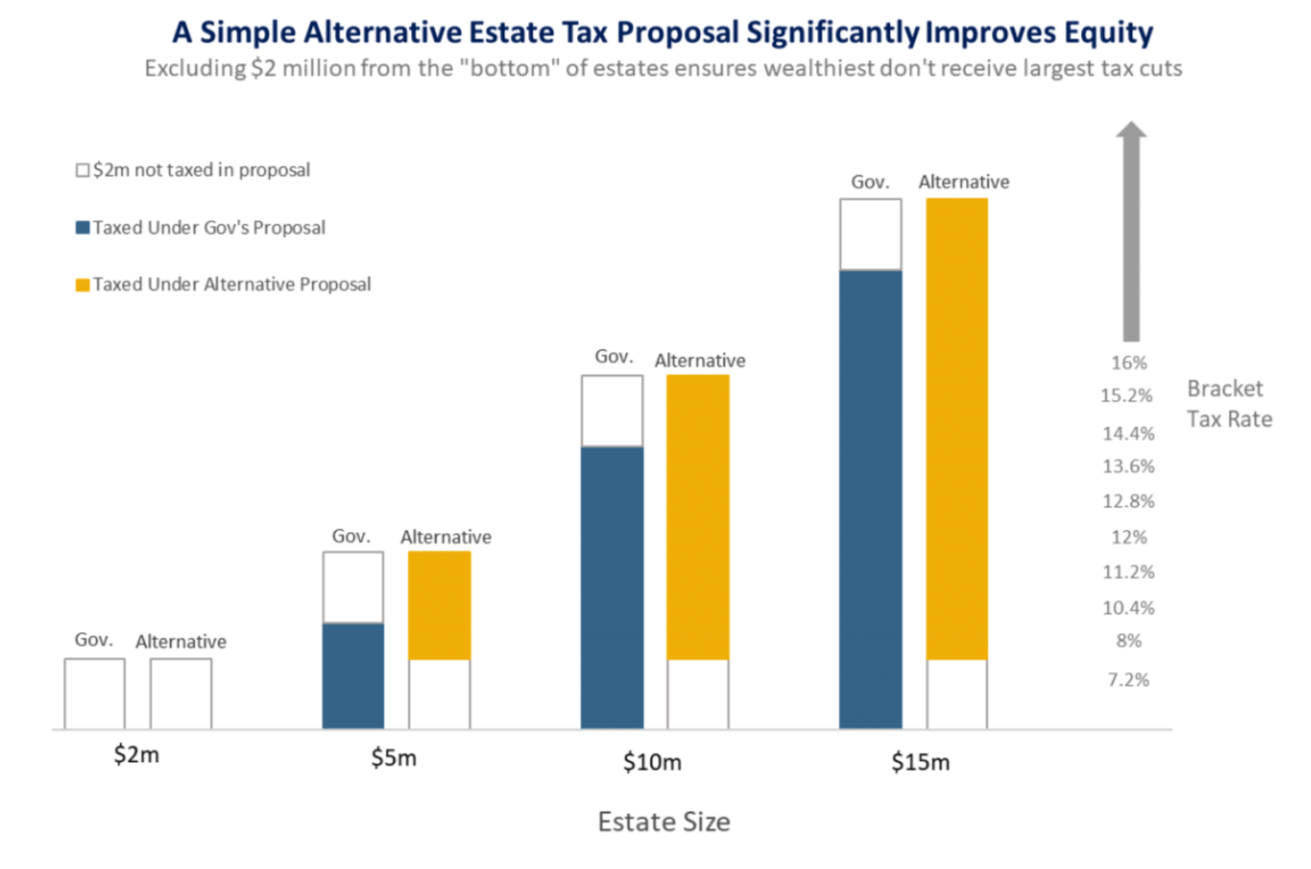

Current Estate Tax Proposals Would Give Largest Benefits To Wealthiest Estates Alternative Method Would Fix This Problem Mass Budget And Policy Center

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

Snowbird Bill Aims To Keep Massachusetts Seniors From Leaving State For Lower Estate Taxes

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

States With Inheritance Tax Or Estate Tax Bookkeepers Com

How Much Is Inheritance Tax Community Tax

Inheritance Tax And Your Massachusetts Estate Plan Slnlaw

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Massachusetts Inheritance Laws What Will Happen To Your Estate If You Die Without A Will Don T Tax Yourself

Estate And Inheritance Taxes By State In 2021 The Motley Fool