marin county property tax due dates 2021

Monday April 12 a date not expected to change due to the COVID-19 pandemic. Lien Date - 1201 am.

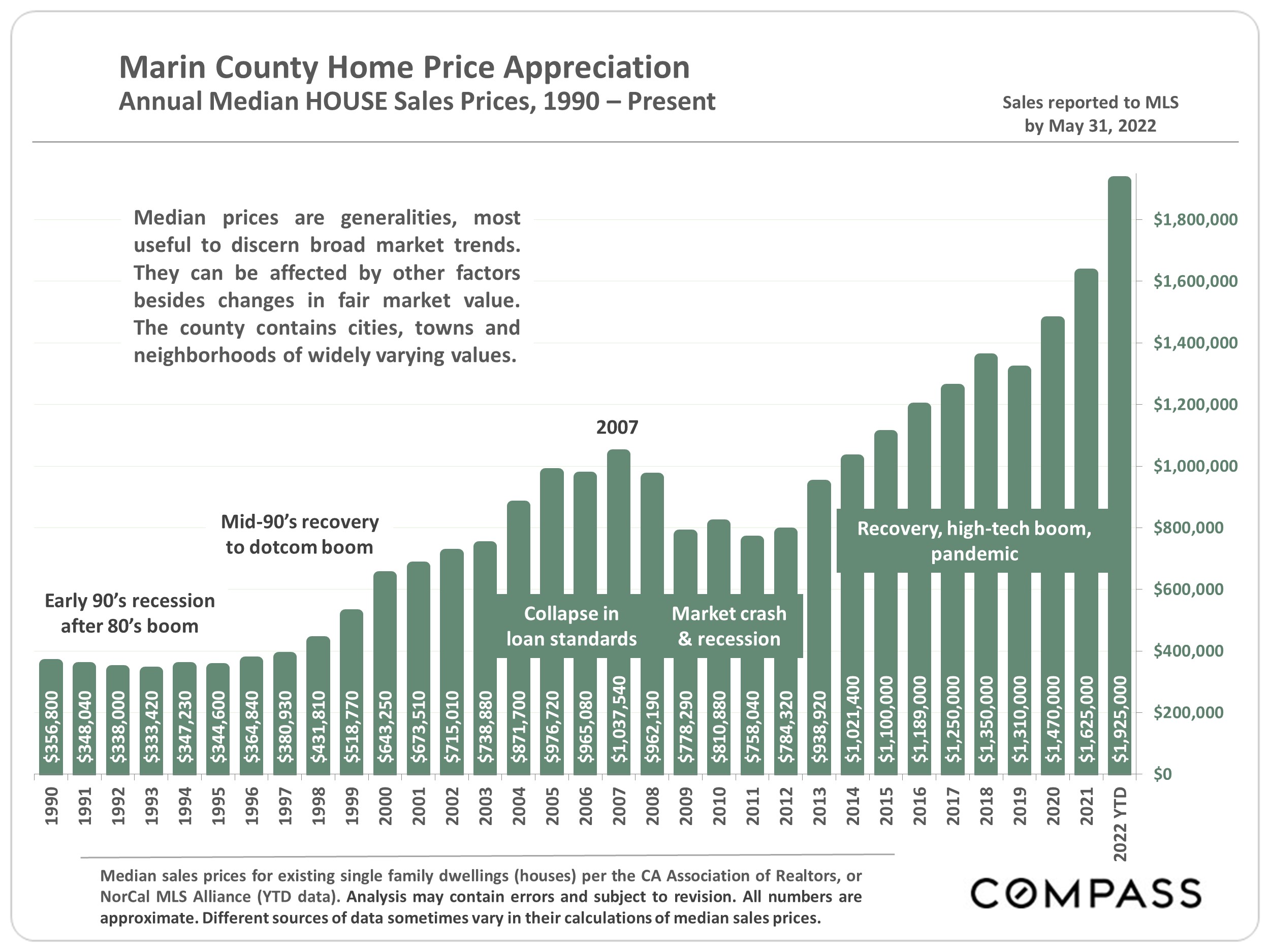

Marin County June 2022 Real Estate Report

If you are a person with a disability and require an accommodation to participate in a.

. Taxes collected in 2022 represent the real estate tax obligations from 2021. MARIN COUNTY CA Marin Countys 2020-21 property tax bills have been sent to property owners. 3501 Civic Center Drive Room 202 San Rafael CA 94903.

The median property tax in Marin. The second installment must be paid by April 10 2021. San Rafael CA The Marin County Tax Collectors Office is reminding property owners that the first installment of property taxes for 2020-21 is due no later than December.

Online or phone payments recommended by Tax Collector. The tax year runs from January 1st to December 31st. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address.

The first installment is due November 1 and must be paid on or before December 10 to avoid penalty. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board. Property tax bills are mailed annually in late September and are payable in.

Ad Find Marin County Online Property Taxes Info From 2021. Marin County taxpayers are being asked to pay. On January 1 preceding the fiscal year for which property taxes are collected.

Local Business Tax Receipts become delinquent October 1st. Property owners who do not receive a tax bill by mid-October especially those who have recently purchased real estate in Marin should email or call the Tax Collectors Office at. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address.

April 01 2022 Second Installment of Property. The hours for the Tax Collectors office and express payment drop box are 9 am. San Rafael CA The first installment of the 2021-2022 property taxes becomes delinquent at 5 pm.

The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up 319 over. Overall there are three stages to real estate taxation. Establishing tax levies estimating property worth and then receiving the tax.

And late fee applies. If you are a person with a disability and require an accommodation to participate in a. The Marin County Department of Finance has mailed out 91854 property tax bills for.

Local Business Tax Receipt renewals due by September 30th. Taxing units include city county governments and various. The time when the taxes become a lien on property and the time property.

MARIN COUNTY CA Marin. On April 9 and 8 am. The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax.

The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax. For questions about property tax billing. San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm.

It S Not Too Late To Apply For A Property Tax Penalty Waiver Your Chances Are Good Mill Valley Chamber Of Commerce Visitor Center

Cutting The Cord In Marin County Complete Guide To Dumping Cable Tv

Chapman Law Group A P C Full Service Bay Area Law Firm

Second Installment Of Property Taxes Due

Marin County Ca Property Data Real Estate Comps Statistics Reports

Password Change Instructions Password Change Instructions

Current Tax Rates Morre Company Llp Cpa Firm In Marin County

George Russell Marin Residents Face Another Property Tax Deadline Marin Independent Journal

Marin County Multifamily Apartments For Sale Cordon Real Estate

Marin County Ford Ford Dealer In Novato Ca

Napa County Policy Protection Map Greenbelt Alliance

Marin County California Ballot Measures Ballotpedia

Secured Property Taxes Treasurer Tax Collector

Marin Economic Forum Did You Know Marin Economic Forum

Marin Library System Seeks Parcel Tax Hike Amid Rising Costs

Sea Of White Marin County Segregation Detailed In Uc Study The Mercury News

Marin County Real Estate Report January 2021 Carey Hagglund Condy Luxury Marin Homes